A contracting economy. Rising mortgage rates. Slowing home price growth.

If you're thinking about buying a home in the Triangle NC real estate market in 2025, it's completely normal to feel uncertain. Many buyers are taking a “wait and see” approach right now—and the headlines aren’t exactly offering comfort.

The U.S. Bureau of Economic Analysis recently reported a 0.3% GDP drop in Q1 2025, following a strong 2.4% gain at the end of 2024. That kind of reversal makes people pause. But here’s the truth:

Smart buyers aren’t waiting—they’re planning.

They’re asking the right questions, analyzing local housing data, and staying proactive. If you want to make a confident move this year or next, here’s a clear, low-pressure path forward.

Step 1: Pinpoint What’s Causing Your Hesitation About Buying a Home

A lot of homebuyers in Raleigh, Durham, Cary, and across the Triangle are saying the same thing:

“I just want to wait and see what happens with the economy. I don’t want to make a mistake.”

Totally fair. Buying a home is one of the biggest financial decisions you’ll make. But instead of freezing, ask yourself this:

What specifically is holding you back?

Are you concerned about higher mortgage interest rates in 2025?

Are you unsure whether home prices in the Triangle will drop?

Are you wondering whether to rent or buy a home in North Carolina right now?

Once you identify the real source of your hesitation, we can weigh the risks, analyze local market data, and help you make a grounded decision—not one based on fear or speculation.

Step 2: Understand What the Triangle Real Estate Market Is Actually Doing

Many would-be buyers are waiting for prices to fall or mortgage rates to drop. But the data tells a different story—especially here in the Raleigh-Durham housing market.

According to the April 2025 national housing report:

Housing inventory is up 30.6% year-over-year, giving buyers more options and stronger negotiating power.

18% of active listings had price reductions in April—the highest April rate since 2016.

Homes are sitting longer, with a national median of 50 days on the market—four days longer than this time last year.

Prices remain stable, with the national median list price at $431,250 and price per square foot up just 1.1%.

Here in the Triangle MLS (covering Wake, Durham, Orange, Chatham, and Johnston Counties), as of early May:

6,688 residential listings are active

Average days on market is 32

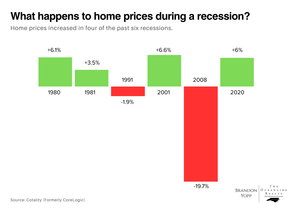

This isn’t a crash. It’s a normalized, buyer-friendlier market. In fact, during 4 of the last 6 U.S. recessions, home prices actually increased—proving that real estate remains one of the most reliable long-term investments.

📍 Remember: Real estate is always local. National headlines matter, but what’s happening in your zip code matters more. That’s where I come in.

Step 3: Build a Home Buying Plan That Aligns With Your Goals

Whether you're aiming to buy this summer or sometime in the next 12 to 18 months, the key is clarity.

Here are your two main options:

Option 1: Create a Short-Term Strategy

If you’re not quite ready, spend the next 6–12 months renting, saving for your down payment, and watching how the Triangle housing market evolves. This puts you in a strong position to act when the time is right.

Option 2: Explore What’s Available Now

With more inventory, less competition, and price reductions happening every day, 2025 could be the right time to buy a home in Raleigh or surrounding areas—especially if you find a seller motivated to make a deal.

There’s no one-size-fits-all answer. That’s why I offer customized guidance, based on your goals, your budget, and your timeline.

Final Thoughts: You Don’t Have to Navigate This Alone

When the economy feels uncertain, it’s tempting to stay on the sidelines. But history has shown that some of the smartest home purchases happen during times of hesitation—because that’s when competition eases, and opportunity quietly opens up.

If you're feeling stuck, unsure, or just want a no-pressure conversation about your next step, I’m here to help. Let’s talk through your questions, your timing, and your plan—whether you’re ready to buy now or next year.

📩 Thinking about buying a home anywhere in the Triangle? Let's build a plan that fits your timeline and goals. Reach out today to schedule a consultation. I'm here to help.

Thanks for reading!

Brandon Yopp