Every time the word recession starts making the rounds in headlines, it tends to rattle nerves—especially if you’re thinking about buying or selling a home in the near future.

You might be wondering:

-

Will home prices crash?

-

Are mortgage rates going to skyrocket?

-

Should I hold off on buying or selling right now?

Totally fair questions. And while it’s easy to get caught up in the uncertainty, the good news is that history gives us some clear guidance.

Let’s separate the fear from the facts.

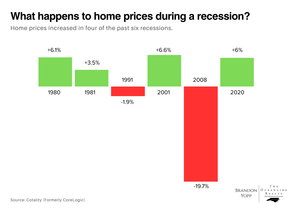

A Recession Doesn’t Automatically Mean a Drop in Home Prices

Let’s bust one of the biggest myths right out of the gate:

A recession doesn’t equal a housing crash.

In fact, according to housing market data from the past six U.S. recessions, home prices actually went up in four of them. In one, prices dipped less than 2%. The only major exception? 2008—which was a unique, financially reckless moment in time driven by high-risk lending, overbuilding, and systemic cracks in the financial industry.

That’s not what we’re seeing today.

Here in the Triangle housing market—Raleigh, Durham, Chapel Hill, Cary, Apex, and surrounding areas—local demand and tight inventory are still driving long-term price resilience.

Home Prices Typically Stabilize, Not Spiral

During a recession:

- Buyer activity may slow, but that doesn’t always lead to falling prices

- Sellers may hold off listing, which keeps inventory low

-

Local market conditions determine how pricing behaves—not headlines

Every real estate market is hyper-local. In the Triangle region, we’ve consistently seen demand outpace supply, especially in sought-after neighborhoods and school districts. That kind of market dynamic supports price stability even when the broader economy cools down.

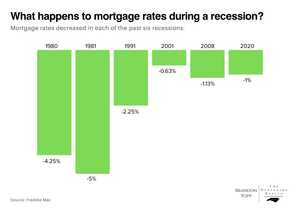

Mortgage Rates Tend to Drop During a Recession

This is where things often work in buyers’ favor.

Historically, mortgage rates tend to decrease during recessions. Why? Because the Federal Reserve typically cuts interest rates to stimulate the economy, which in turn drives mortgage rates lower.

Freddie Mac’s data shows mortgage rates fell during each of the last six U.S. recessions.

Now, let’s be real—rates likely aren’t going back to the rock-bottom 3% we saw in 2020. But even a modest drop can make a big difference in monthly payments, overall affordability, and long-term equity growth.

If you’re a buyer watching the market, this could be the window you’ve been waiting for.

Today’s Homeowners Are in a Stronger Financial Position

One of the biggest reasons we’re not headed for a 2008-style crash is equity.

Thanks to years of consistent price growth and more responsible lending, most homeowners today have substantial equity in their homes. Realtor.com looked into the Federal Reserve data and found that:

-

Even if home values dropped by 10%, average equity would still be at levels similar to 2021

-

A 20% price dip would only bring us back to 2019 equity levels

-

Over 50% of homeowners have mortgage rates under 4%, giving them no reason to panic sell

Bottom line? We’re not likely to see a flood of foreclosures or distressed sales. That alone creates a powerful floor under home values—even during tougher economic periods.

So What Should Buyers and Sellers Do Right Now?

If you’re in the market to buy or sell in the Triangle area, this is where having a local expert matters more than ever.

Real estate isn’t just about national trends—it’s about your unique goals, your timeline, and your local market.

I’m here to help you cut through the noise and make smart, confident decisions that fit your life—not the headlines.

If you’ve got questions about what a shifting market means for your next move, reach out to me via this email link. I’ll always shoot straight with you, and I’ll always have your best interests at heart.

Thanks for reading!

Brandon Yopp