The 2025 housing market is shaping up to be an interesting one—steady growth, more inventory, and a bit of breathing room for buyers. But let’s be real: behind every steady forecast lies a handful of wild cards that could shift the game.

From unexpected mortgage rate swings to federal policies that could either boost supply or throw a wrench in the system, there’s plenty to keep an eye on this year. Let’s break it all down—what the experts predict and what could really shake things up.

The Big Picture: What Experts Are Saying About 2025

Before diving into the wild cards, let’s take a look at what the forecasts say about home prices, sales, inventory, and mortgage rates.

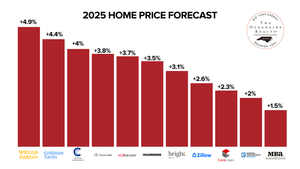

1. Home Prices: Modest Increases Ahead

Analysts forecast modest home price growth in 2025, with projections ranging from 2% to nearly 5% increase.

While home prices are still climbing, the pace is slower compared to recent years. This is good news for buyers facing affordability challenges, although slight increases still favor sellers who can expect equity gains.

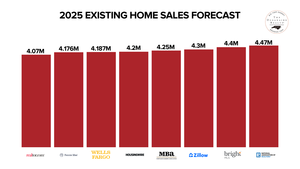

2. Home Sales: Slight Rebound in Activity

After a sluggish 2023 and 2024, existing home sales are projected to recover slightly in 2025.

Higher sales activity signals a healthier market, but the pace will depend on mortgage rates and inventory growth. Sellers may benefit from increased demand, while buyers will appreciate slightly more options.

3. Inventory: A Step Toward Balance

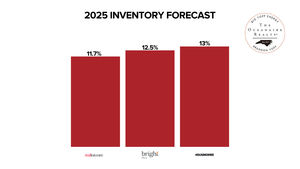

Economists agree—we can expect an increase in national housing inventory in the double digits:

Inventory is finally improving, giving buyers more options and a bit more negotiating power. However, we’re still not back to pre-pandemic levels, so don’t expect the competition to disappear completely.

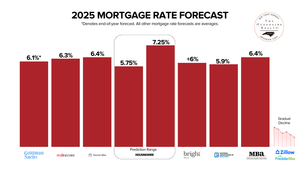

4. Mortgage Rates: A Wild Ride Ahead

Mortgage rates are the biggest question mark. Most analysts predict rates hovering around 6%, but fluctuations throughout the year could create opportunities for those who act quickly.

Buyers can be on the lookout for rate dips to lock in better terms. For sellers, rates might limit what buyers can afford, so pricing smartly will be key.

The Wild Cards That Could Shake Things Up

Now for unpredictable factors that could throw the market forecasts into disarray. Here’s what you need to keep an eye on, according to Realtor.com.

1. Mortgage Rate Surprises

While forecasts suggest mortgage rates will hover around 6%, unexpected factors could lead to volatility. Economic growth, inflationary pressures, and Federal Reserve policy decisions will all play a role in determining where rates go.

The Trump administration’s fiscal policies—including deficit-funded tax cuts and increased spending—could drive inflation higher, keeping mortgage rates elevated. Conversely, successful efforts to curb inflation might stabilize rates or lead to a gradual decline.

What It Means for You:

- Buyers: Stay flexible and prepared to lock in a rate during any dips.

- Sellers: Be ready to adjust your pricing strategy if rates rise and buyer budgets shrink.

2. Federal Housing Policies

With a Republican sweep of the presidency and Congress, new policies could either bolster the housing market or add to its challenges. President-elect Trump has proposed initiatives to decrease building costs and increase supply, including opening federal land for homebuilding and reducing regulatory costs.

However, other policies—such as stricter immigration laws and increased tariffs—could raise construction costs and slow the progress of new home development.

What It Means for You:

- If supply increases, buyers may see more affordable options, easing competition.

- However, higher construction costs could offset these benefits, keeping affordability out of reach for many.

Real estate is always full of surprises, but that’s what makes it exciting. Want to know how these trends could impact you locally? Reach out to me directly so that we can strategize for your 2025 goals.

Thanks for reading!

Brandon Yopp